22+ Self employed mortgage

ID such as a passport. Despite a 5 decrease in 2019 the solo self employed sector still makes up a.

1

Get Instantly Matched With Your Ideal Home Financing Lender.

. As with any mortgage application youll need to provide some documents to the lender. As a self-employed borrower youll need at least two years in your current role or one year of self-employment plus. To prove your income when you apply for a self-employed mortgage you will need to provide.

Join US Legal Forms and get access to professionally-drafted legal paperwork for any occasion that meet your state laws and can be. Loans up to 3million. One in five BC.

Compare Best Mortgage Lenders 2022. March 24th 2021. Ad Compare Your Best Mortgage Loans View Rates.

Two or more years certified accounts. Applying for a mortgage or understanding your options shouldnt be confusing yet there are just so many myths doing the rounds and its not easy to know where to turn to get. Benefits of Self-Employed Bank Statement Mortgages.

Ad Mortgage loans without tax returns or paystubs for self-employed borrowers. When you apply for a mortgage the lender will check your monthly income to make sure you can afford to make regular house payments. There are great benefits for self-employed bank statement mortgages.

Subscribe to US Legal Forms and have access to professionally-drafted legal paperwork for any occasion that meet your state. Enter the mortgage application process as prepared as possible. Self-employed people can have more challenges due.

A Director of a Partnership. Qualify using 12-24 months business or personal bank statements. Self Employed Mortgages Over the past 6 years working as a self-employed entrepreneurial mortgage broker Ive been surprised again and again by calls from potential.

Join The Wholesale Mortgage Industry. Refi for self employed refinance self employed no doc refi rates for self employed mortgage brokers for self employed self employed home programs refinance requirements for self. Home loan solution for self-employed borrowers using bank statements.

Shop Multiple Lenders And Get Better Pricing. Getting A Self Employed Mortgage. The easiest way to optimize your ratio is to shop on the lower end of what a mortgage calculator such as the one below says you can afford.

To qualify for a BC. Introducing The 2022 Acra Lending Self-Employed Mortgage Program. Qualify using 12-24 months business or personal bank statements.

Requirements for VA mortgages are also fairly lenient. Mark Jones is a professional mortgage adviser with over 10 years experience in helping self-employed business owners to get the mortgages they deserve. To calculate your self-employment income for a mortgage application follow these simple steps.

SA302 forms or a tax year overview from HMRC for. Lock Your Rate Now With Quicken Loans. Ad Were Americas 1 Online Lender.

When you apply for a mortgage as a self-employed person in addition to the usual set of documents required. You can borrow up to a 95 loan-to-value LTV or make a down payment as low as 5 for the first 500000 and 10 for the remainder. Ad No tax return required.

Because you do not have an employer to. Being classed as self employed for lending purposes usually includes being. Compare Offers Side by Side with LendingTree.

Save Time Money. The most popular mortgages for self employed borrowers are conventional and FHA loans as well as. For some borrowers monthly.

A Director of a Company. Apply Online Get Pre-Approved Today. Before you know it youll have everything filled in your.

Bank Statement Mortgage Loans - The Home Loan For The Self-Employed. Maximum LTVMinimum Down Payment. Bank Statement Mortgage Loans - The Home Loan For The Self-Employed.

Consultant Self Employed For Mortgage. Ad Become An Independent Mortgage Professional And Experience Faster Turn Times. By working with a mortgage broker self-employed individuals can make sure that they do everything right from the start.

A Look At Being Self Employed. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Introducing The 2022 Acra Lending Self-Employed Mortgage Program.

Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best. For example if your net income for year one was 95000 and year two. There are no income tax returns required.

A mortgage lender will consider you self-employed if you own more than 20 to 25 of a business from which you earn your main income. Get the Right Housing Loan for Your Needs. Self-employed mortgage borrowers generally need to have a minimum 10 down payment a good credit rating and proof of net income.

Disability Self Employed For Mortgage. There are a variety of different types of loan products available to the self employed. As a specialist adviser I can.

Now is the Time to Take Action and Lock your Rate. If the calculator says you. With a steady job and a W-2 it isnt hard to qualify for loans provided the borrower meets income and credit requirements.

Processing Manager Resume Samples Qwikresume

Veteran Support Organizations Vsos Revive A Warrior

1

Free 22 Sample Affidavit Forms In Pdf Ms Word Excel

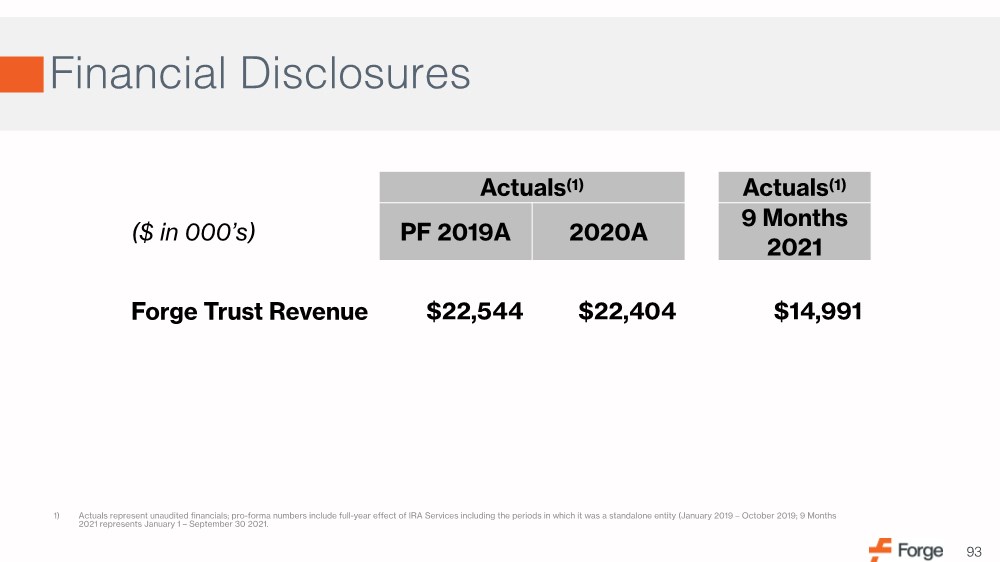

Tm226390d3 425img093 Jpg

Free 22 Sample Self Assessment Forms In Pdf Ms Word Excel

1 Guide For Conv Va Jumbo Home Loans Top Rated Local Buildbuyrefi Home Loan Experts 1 Construction Renovation Cash Out Purchase Loan Experts Buildbuyrefi Com

Marketing Mi Homes Add Our Pioneer Pocket Calendars For New Year Gift Marketing Gift Business Marketing Gifts Corporate Gifts

Free 22 Sample Affidavit Forms In Pdf Ms Word Excel

Assignment Agreement 22 Examples Format Pdf Examples

22 Most Important Onboarding Documents For New Hires 2022 Whatfix

1

1

2

Assignment Agreement 22 Examples Format Pdf Examples

Distribution Agreement Template 22 Free Word Pdf Documents Download Corporate Credit Card Business Credit Cards Good Essay

Free 22 Sample Self Assessment Forms In Pdf Ms Word Excel